GST Search Proceedings

– CA Punit Prajapati

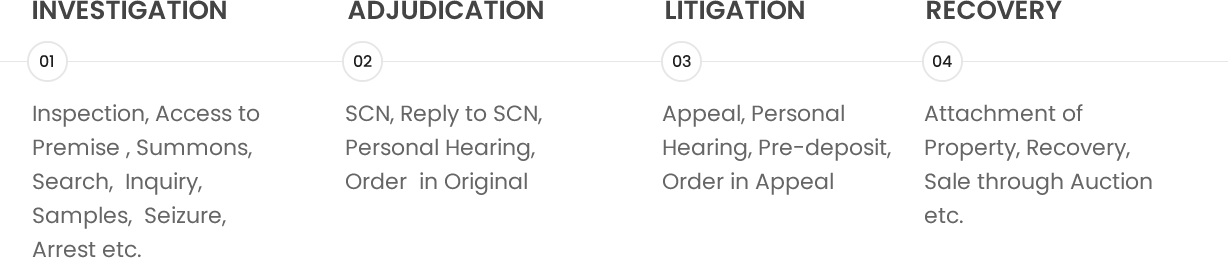

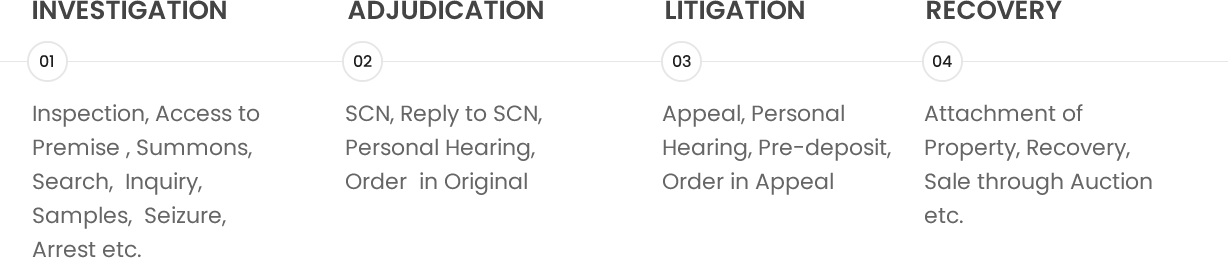

STAGES

Options to Enter Premises

ACCESS

U/S. 71 |

INSPECTION

U/S. 67(1) |

SEARCH

U/S. 67(2) |

| Normal power to access documents etc of registered person |

To inspect a place of business of taxable person |

To Search and Seize goods liable for confiscation or useful documents |

ACCESS OF BUSINESS PREMISE SECTION 71

(1) Any officer under this Act, authorised by the proper officer not below the rank of Joint Commissioner, shall have access to any place of business of a registered person to inspect books of account, documents, computers, computer programs, computer software whether installed in a computer or otherwise and such other things as he may require and which may be available at such place, for the purposes of carrying out any audit, scrutiny, verification and checks as may be necessary to safeguard the interest of revenue.

INSPECTION SECTION 67(1)

(1) Where the proper officer, not below the rank of Joint Commissioner, has reasons to believe that––

- (a) a taxable person has suppressed any transaction relating to supply of goods or services or both or the stock of goods in hand, or has claimed input tax credit in excess of his entitlement under this Act or has indulged in contravention of any of the provisions of this Act or the rules made thereunder to evade tax under this Act; or

- (b) any person engaged in the business of transporting goods or an owner or operator of a warehouse or a godown or any other place is keeping goods which have escaped payment of tax or has kept his accounts or goods in such a manner as is likely to cause evasion of tax payable under this Act,

he may authorise in writing any other officer of central tax to inspect any places of business of the taxable person or the persons engaged in the business of transporting goods or the owner or the operator of warehouse or godown or any other place.

SEARCH – SECTION 67(2)

Where the proper officer, not below the rank of Joint Commissioner, either pursuant to an inspection carried out under sub-section (1) or otherwise, has reasons to believe that any goods liable to confiscation or any documents or books or things, which in his opinion shall be useful for or relevant to any proceedings under this Act, are secreted in any place, he may authorise in writing any other officer of central tax to search and seize or may himself search and seize such goods, documents or books or things:

Any other power to enter premise?

Is there any other provision which empowers officer to enter business or other premise?

Difference

| Description |

Access |

Inspection |

Search |

| Intention |

To carry out audit, security, verification and checks |

To inspect transactions which may lead to tax evasion |

To find out and seize secreted goods and articles |

| Intention to Evade tax |

No required |

Required |

Required |

| Place |

Business Place |

Business Place |

Any Place |

| Seizure of Goods or Documents |

Not Possible |

Not Possible |

Possible |

| Power to Break or Seal |

Not Available |

Not Available |

Available |

REASON TO BELIVE

- Must be recorded in writing

- Can not be mere assumption of the officer

- Must be based on some material or evidence which suggest evasion

- Entire proceeding of search will be invalid if done without recording reason to believe

STEPS IN INSPECTION AND SEARCH

- Gathering of Intelligence

- Authorisation by Joint Commissioner (Form INS-01)

- Arrival and disclosure of Identity of Officers

- Offer Personal Search of Officers

- Signature of Party on Search Warrant (INS-01)

- Additional Authorisation for Search in INS-01 if not availed earlier

- Access to Alimirah, electronic Device, box etc.

- Recording of Statement (if required)

- Spot Recovery

- Seizure (INS-02)

- Order of Prohibition (INS-03)

- Panchnama

- Offer Personal Search of Offers

PROCEDURE TO BE FOLOWED Instruction No. 01/2020-21 Dated 02/02/2021

- DIN number (For Central)

- Only of person for whose premise search warrant is issued

- Lady officer for residence

- Independent Panch

- Signature of party on search warrant with time and date

- Panchnama shall be made

- Videography for sensitive premise

- Social and religious sentiment

- Children should be allowed to go school (after verification of bags)

- Copy of panchnama shall be given

- Copy of statement may be given (If not, record in panchnama)

STEPS POST INSPECTION AND SEARCH

- Search is starting of investigation, not end

- Recoding of statements, cross verification, verification of documents seized, concluding statement etc. will follow

- Provisional Attachment (Section 83)

- If everything is paid, matter will be closed

- If not SCN under section 74 will be issued

Other issues for Search

- No Manhandling

- Presence of Consultant

- Spot Recovery

- Mere Long time of search is not harassment

- No procedure under Section 129 for search (Mahavir Polyplast (All. HC)

Provisional Recovery – Section 83

- Where, after the initiation of any proceeding under Chapter XII, Chapter XIV or Chapter XV, the Commissioner is of the opinion that for the purpose of protecting the interest of the Government revenue it is necessary so to do, he may, by order in writing, attach provisionally, any property, including bank account, belonging to the taxable person or any person specified in sub-section (1A) of section 122, in such manner as may be prescribed.

- Every such provisional attachment shall cease to have effect after the expiry of a period of one year from the date of the order made under sub-section (1).

Provisional Recovery – Para 3.1.3 of CBIC Instruction

Consider

- Nature of Offense

- Amount Involved

- Established nature of business

- Extent of Capital investment

- Reason to believe that tax payer will dispose ore remove property

Officers to Assist Section 72

- All officers of Police, Railways, Customs, and those officers engaged in the collection of land revenue, including village officers, officers of State tax and officers of Union territory tax shall assist the proper officers in the implementation of this Act.

- The Government may, by notification, empower and require any other class of officers to assist the proper officers in the implementation of this Act when called upon to do so by the Commissioner.

Assessment proceedings, etc., not to be invalid on certain grounds –Section 160(2)

(2) The service of any notice, order or communication shall not be called in question, if the notice, order or communication, as the case may be, has already been acted upon by the person to whom it is issued or where such service has not been called in question at or in the earlier proceedings commenced, continued or finalised pursuant to such notice, order or communication.

Arrest

- If arrest can be made, not necessary shall be made

- Bailable & Non Bailable Offence

- Cognizable and Non Cognizable Offence

- Default Bail if no charge sheet within 60 days

- Anticipatory Bail

Other Issues

Presence of consultant during search

Retraction of Statement

Spot Seizure

Drawing of Sample (Section 154)

Inspection/Search & Adjudication by different authority